How to Accurately Identify Retained Earnings for Your Business in 2025

Identifying retained earnings is essential for understanding your business’s financial health. In this article, we will explore the importance of retained earnings, their definition, and practical methods for calculating them effectively. As you plan for 2025, having a solid grasp of your company’s retained earnings can influence decisions on dividends, reinvestment, and overall growth strategy.

The Basics of Retained Earnings

To begin with, it is crucial to have a comprehensive retained earnings definition. Retained earnings represent the cumulative amount of net income that has been retained by your business rather than distributed to shareholders as dividends. This figure is a part of the equity section of your balance sheet and reflects how profits are utilized within the business. Essentially, every business owner should understand retained earnings in accounting as a vital indicator of financial robustness and growth potential.

Understanding the Retained Earnings Formula

The retained earnings formula is straightforward:

Retained Earnings = Previous Retained Earnings + Net Income - Dividends

In this calculation, the previous retained earnings are taken from the end of the prior period, net income is the profit earned during the current period, and dividends are distributions made to shareholders. This formula helps in determining retained earnings at the end of each accounting period and is crucial for producing a retained earnings statement as part of annual financial reporting.

The Significance of Retained Earnings

The importance of retained earnings cannot be understated—they are critical for funding future growth initiatives without the reliance on external financing. For example, a growing company may opt to reinvest its earnings to expand operations, thus experiencing an increase in retained earnings. As business owners strive to create value for stakeholders, understanding the significance of retained earnings becomes essential for strategic planning.

Calculating Retained Earnings Accurately

Now that we have a foundational understanding, let’s delve into how to calculate retained earnings accurately. Depending on the complexity of your business’s finances, this might require a more detailed approach to manage the various inputs effectively.

Using a Retained Earnings Statement Example

A retained earnings statement example can aid in understanding how these calculations come together. Suppose you are examining financial statements for a small business at the end of the fiscal year. Here’s a breakdown of how you might compile this statement:

Beginning Retained Earnings: $100,000 Net Income for the Year: $30,000 Dividends Paid: $10,000 Ending Retained Earnings: $100,000 + $30,000 - $10,000 = $120,000

This process will enable you to see trends over successive years, allowing a more profound insight into the business trajectory through retained earnings.

Analyzing Retained Earnings Trends

To effectively manage your financial strategy, analyzing retained earnings trends is vital. Businesses often conduct periodic reviews of their retained earnings balance to evaluate performance against industry standards. Quarters showing significant increases may indicate profitable operations and prudent expense management, while declines may exemplify areas for improvement. Understanding the contributing factors will better position your company for future success.

Common Retained Earnings Issues

Despite the clarity, there are common challenges that can arise regarding retained earnings. Issues such as inaccurate financial reporting or mismanagement of profits are not uncommon.

Identifying Retained Earnings on Financial Statements

Finding retained earnings in the balance sheet typically involves verifying the financial statements. Within equity, you’ll observe retained earnings listed alongside other attributes such as share capital. It’s important to also view the correlation between retained earnings and dividends as this reflects company policy regarding profit distribution.

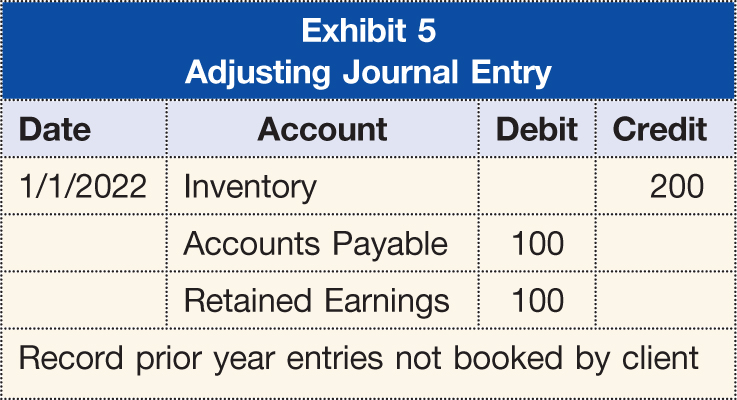

Addressing Retained Earnings Adjustment Entries

Any discrepancies might require influencing retained earnings adjustment entries. For instance, if profits were overstated in previous reports due to an accounting error, rectifying this could involve adjusting retained earnings downwards, significantly impacting your financial statements. Regular adjustments help maintain accuracy and compliance with financial reporting standards.

The Role of Retained Earnings in Financial Planning

Understanding how retained earnings impact your company’s financial landscape is indispensable for effective financial planning.

Retained Earnings and Business Growth

The relationship between retained earnings and business growth is profound. A robust retained earnings balance positions your business to finance new projects or expand operations, reducing reliance on retained earnings versus net income analysis. By continuously retaining a portion of the profits, businesses can sustain growth momentum without incurring heavy debts.

Impact of Retained Earnings on Business Valuation

How retained earnings affect business valuation is essential for creating an accurate picture of company value, especially when seeking investors or partnerships. Higher retained earnings typically indicate a well-managed business with potential for expansion, thereby affecting negotiation leverage.

Key Takeaways

- Retained earnings are vital for evaluating a business’s financial health and making strategic decisions.

- Understanding the retained earnings formula facilitates accurate financial reporting.

- Analyzing retained earnings over time helps track performance and make necessary adjustments.

- Proactive management of retained earnings can enhance growth and valuation efforts.

FAQ

1. What is the retained earnings purpose in business?

The retained earnings purpose is to help businesses finance their growth without relying on external debts. This allows for reinvestment in opportunities that will ultimately contribute to increased profitability and shareholder value.

2. How do retained earnings affect cash flow?

The relationship between retained earnings and cash flow is intertwined. While retained earnings reflect funds retained rather than distributed, actual cash flow may be impacted by how profits are utilized. Businesses need to balance retained earnings management with maintaining sufficient cash flow for operations.

3. Can retained earnings be negative?

Yes, negative retained earnings occur when a company’s cumulative losses exceed its profits. This situation may indicate financial instability; hence, management should assess the underlying reasons and corrective avenues.

4. Are retained earnings the same as cash?

No, retained earnings are not the same as cash. While both reflect financial metrics, retained earnings show cumulative profits reinvested in the business, whereas cash indicates the liquidity available for operational needs or distribution to shareholders.

5. What can be done to improve retained earnings as a small business?

To improve retained earnings for small businesses, owners can focus on enhancing profitability by increasing sales, reducing expenses, and controlling cash outflows. Developing effective profit retention strategies and reinvesting into the business can also foster growth.

6. How often should businesses report retained earnings?

Ideally, businesses should assess and report their retained earnings at least quarterly, aligning this review with financial statement reporting cycles to ensure transparency and continual performance tracking.

7. What happens to retained earnings upon liquidation?

Upon liquidation, retained earnings are typically dissolved along with the company, and any remaining assets are split among shareholders after paying off debts. This process underscores their relevance in maintaining corporate longevity and financial planning.