How to Easily Cancel Your Experian Membership

Understanding How to Cancel Your Experian Account

Canceling your Experian membership can be a straightforward process if you follow the right steps. As service options become increasingly popular, knowing **how to cancel your Experian account** is essential for managing your online subscriptions effectively. To embark on this journey, start by gathering your account details, as they will be necessary for initiating the cancellation request. The process can vary between cancellation methods, whether attempting to cancel your subscription online or through customer service. By familiarizing yourself with the right approach, you can significantly speed up the cancellation process and avoid any headaches.

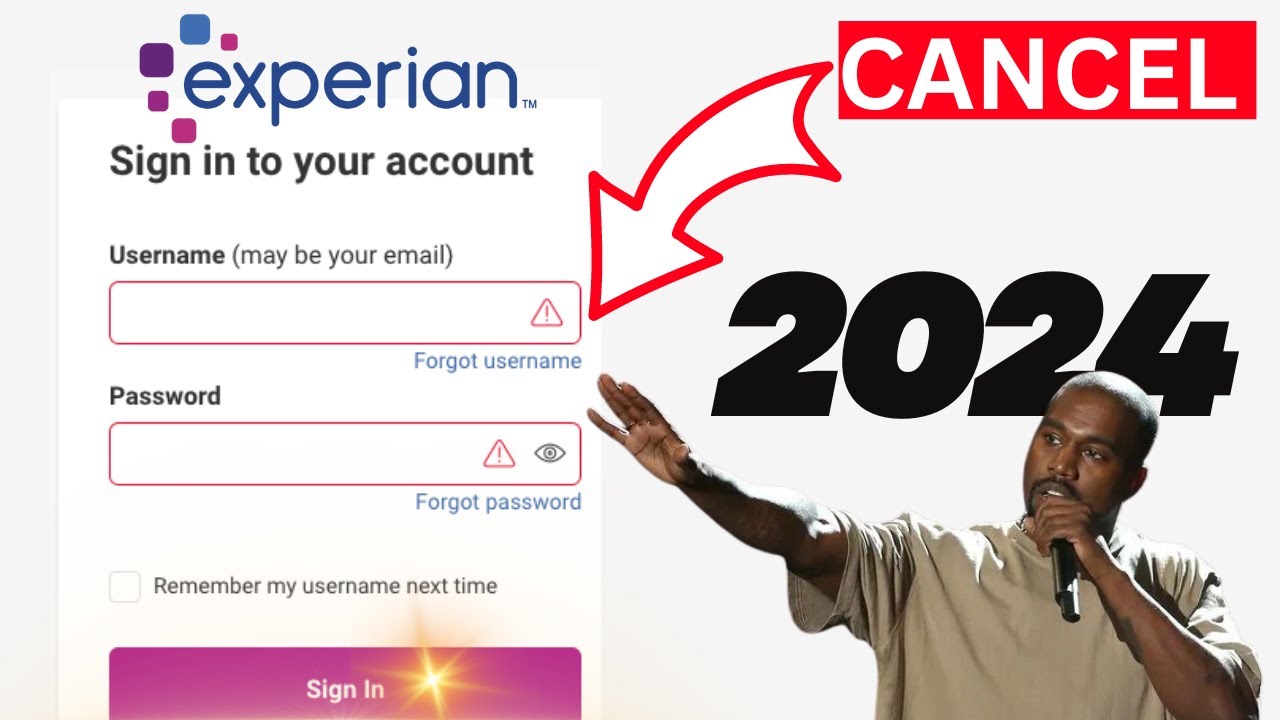

Step-by-Step Guide to Cancel Experian Subscription Online

If you are looking to **cancel your Experian subscription** without hassle, the first step is to log in to your Experian account. Once you are logged in, navigate to the account settings or membership management section. Here, you can find the option to request cancellation. It often involves a few simple clicks. If you encounter any issues, consider using the FAQs section or **contacting Experian support** for assistance. After submitting your cancellation request, keep an eye on your email for confirmation. It’s crucial to check that the cancellation is processed successfully to avoid being charged in the next billing cycle.

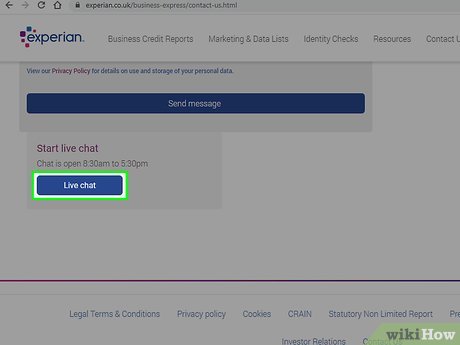

Requesting Cancellation of Experian Membership Via Customer Service

<pFor those who prefer a personal touch when dealing with such matters, you can always opt to **terminate your Experian account** by reaching out to customer service. This method gives you the opportunity to ask any questions and express concerns directly. Call the **Experian customer service number** and explain your request clearly. Be sure to have your personal information at hand, as they may require it for verification purposes. Once they process your request, you will receive a confirmation. Remember, communication is crucial, especially if you run into challenges throughout the process.

Common Reasons for Canceling Your Experian Membership

There are many reasons why someone might choose to **stop Experian services**. Some may no longer require credit monitoring due to personal changes, while others might find better alternatives that suit their financial needs. Additionally, issues such as dissatisfaction with service, financial considerations, or privacy concerns can all play a role. Evaluating these factors can guide your decision-making process regarding whether to **unsubscribe from Experian** membership or continue using their services.

Impacts of Terminating Your Experian Account

When you decide to **close your Experian account**, it’s important to consider the impacts of this decision. On one hand, canceling your Experian services can lead to decreased visibility into your credit score and reports, which can be vital for making informed financial decisions. On the other hand, it allows for better control over your personal information, especially if you’re concerned about **privacy issues with credit services**. Understanding these implications helps paint a complete picture before you proceed with terminating your relationship with Experian.

Stopping Payments to Experian and Understanding Membership Fees

One significant aspect of cancellation is ensuring you successfully stop payments to Experian. Upon successfully **disabling your Experian account**, check your bank account and credit card statements to confirm no further charges occur. If you were on a paid plan, ensure you read up on any membership fees, potential refunds, and your rights as a consumer. There are circumstances where you could be eligible for a refund following a cancellation, especially if you cancel within a trial period or after an unexpected billing error.

Dealing with Credit Monitoring Post-Cancellation

It’s wise to put some thought into **how to discontinue Experian membership** concerning your credit monitoring needs. Post-cancellation, learn about alternative credit monitoring services to assess which fits your requirements better. There are various options available that might offer different features or pricing structures. Use this time to research and gather insights about what’s available and tailor your personal finance strategy to include tools that provide adequate coverage for your financial security.

Alternative Options to Consider

If discontinuing your membership leads you to explore new options, understanding the alternatives can significantly aid your transition. There are numerous **alternative services to Experian** that you might find beneficial, especially if you’re searching for specific features or lower rates. Comparing these options will help you choose the right fit for future credit management tasks.

Exploring Credit Monitoring Alternatives

For many consumers, finding a suitable replacement for the **credit monitoring Experian** offers is essential to maintaining their financial health. Services such as Credit Karma or Equifax may provide similar insights with varied features. Take into consideration what service options are important to you, whether it be free alerts or deep financial analysis, to ensure you stay informed about your financial standing. In doing so, not only will you maintain your credit awareness, but you’ll likely realize cost-effective solutions too.

Importance of Managing Your Financial Data

Your financial data is an invaluable asset; understanding how to manage it effectively post-Experian membership is key to protecting it. Monitor your credit reports closely, ensuring any inaccuracies are corrected promptly. Your financial health depends not just on creating good credit habits, but also on embracing robust data management practices. Utilizing tools to check your credit score frequently reassures you that your financial situation remains under control.

Key Takeaways

- Understand how to cancel your Experian membership through various methods—online or via customer service.

- Be aware of the implications of terminating your Experian account for your credit monitoring.

- Explore alternative credit services that provide suitable options to meet your financial needs.

- Ensure all payments are stopped following your subscription cancellation.

FAQ

1. How can I cancel my Experian free trial?

To **cancel your Experian free trial**, log into your account, visit the account management section, and select the option to terminate the trial. You may also contact Experian’s customer service for assistance with the process, making sure to act before the trial expires to avoid charges.

2. What information do I need to remove my Experian membership?

To successfully **delete your Experian membership**, you typically need to provide identifying information such as your account number, email associated with the account, and possibly answers to security questions.

3. Can I get a refund after canceling my Experian subscription?

Depending on the terms of your subscription, it is possible to request a **refund for your canceled Experian subscription**. Typically, if you cancel within your trial period or you identify a billing error, you may be eligible for reimbursement.

4. How do I understand membership fees with Experian?

Reviewing the **membership agreement** when you sign up is essential for understanding fees associated with your Experian membership. In case of any questions, you can always reach out to **Experian customer service** for clarifications on any fees or policies.

5. What should I do after canceling my Experian membership?

After **canceling your Experian membership**, it’s important to closely monitor your financial data. Transition smoothly by checking your credit score regularly and researching alternative credit monitoring options that suit your needs.

6. Is there a way to stop Experian from charging me inadvertently?

To **stop Experian from charging**, make sure that your membership is fully canceled. Confirm with Experian via phone or their live chat support if you need assistance. Always check your billing statements closely to catch any unauthorized charges.

7. How do I contact Experian support effectively?

To effectively **contact Experian support**, use their customer service number or opt for a live chat option on their website. Providing your account details and clearly stating your inquiry can help expedite the resolution process.