Effective Ways to Find Expected Value in 2025

Understanding Expected Value

The concept of expected value is fundamental in statistics, used extensively in decision-making and risk assessment. In essence, the expected value represents the average outcome of a random variable over numerous trials, reflecting both the values and the probabilities associated with possible outcomes. In 2025, techniques to calculate expected value are becoming increasingly important, given the rising demand for quantitative insights in various fields, including finance, economics, and statistical analysis.

The Expected Value Formula

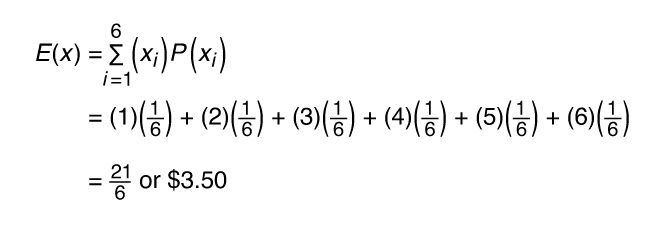

At the heart of calculating expected value is its formula: EV = Σ (P(x) * x), where P(x) represents the probability of outcome x occurring. This method sums the products of each possible outcome and its likelihood, resulting in a weighted average that reflects the outcomes anticipated. Understanding how to apply this formula accurately is crucial for anyone involved in data analysis or making informed financial forecasts.

Mature Usage of Expected Value in Financial Forecasting

In the realm of finance, calculating the expected value of various investment strategies allows individuals and organizations to weigh the expected returns against potential risks. By analyzing historical data and utilizing probabilistic models, stakeholders can derive a comprehensive perspective on statistical expectation. A thorough understanding of expected outcomes not only aids in portfolio management but also enhances scenario analysis and risk management capabilities.

Impact of Expected Value on Decision Making

Employing expected value in decision-making processes can have profound implications. For example, consider a gamble involving a coin flip: if you win $2 for heads (probability 0.5) and lose $1 for tails (probability 0.5), the expected value would be {EV = (0.5 * 2) + (0.5 * (-1)) = $0.50}. Understanding this expected payoff before placing a bet enables better risk assessment and assists individuals in creating more effective investment strategies. Thus, it invites more considered choices in bringing strategic insights to light.

Applications of Expected Value in Risk Evaluation

Integrating expected value in risk evaluation enables robust predictive analytics. By transforming uncertain outcomes into quantified risks, analysts can determine a strategy that minimizes potential losses while enhancing possible gains. The successful application of this method is pivotal in areas such as economic forecasting and financial modeling.

Quantifying Uncertainty with Expected Value

Quantifying uncertainty—often necessary in financial derivatives and other investments—benefits greatly from the expected value framework. Analyze a scenario of portfolio choices: one asset class may promise higher returns but inherently carries more risk. Evaluating the expected value and comparing different probability distributions allows investors to understand which asset aligns best with their risk tolerance. Financial analysts often utilize simulations such as Monte Carlo simulation to enhance decision optimization by reinforcing their planned strategies with empirical data.

Expected Value in Economic Analysis

The application of expected value in economic analysis extends to public policy and business strategy. In clarification, government projects can harness this principle to estimate the effectiveness of investment versus social gains by weighing costs against benefits. An example includes using scenario analysis for infrastructure projects to ensure budget allocation aligns with maximum expected benefit, leading to substantial return on investment.

Using Statistical Models for Value Estimation

Utilizing statistical models alongside expected value helps evaluate outcomes effectively. Models can include regression analysis that illustrates how changes in one predictor lead to shifts in another, which allows for powerful insights in economic forecasting. By combining these techniques, economists can present compelling arguments that lead to meaningful predictions and well-etched valuation techniques.

Case Studies Demonstrating Effective Use of Expected Value

Engaging with real-world scenarios reveals how expected value principles play out, especially within the realm of game theory and decision analysis. Case studies illustrate that industries ranging from investment banking to insurance leverage expected outcome calculations to inform strategies that can adapt to various market conditions.

Successful Application in Gaming Strategies

In gaming and trading environments, identifying probabilities and their corresponding impacts can allow players to hone their tactical acumen. A classic example is poker, where players estimate the expected value of their hands to make strategic decisions based on mathematical expectation. By applying mean value calculations, they can improve their overall performance measurement and reap the benefits of discerning high-stake plays versus conservative approaches.

Insurance Models Using Expected Payoff

In insurance, calculating the expected payoff on various policies helps assess risks accurately. The insurer can mitigate potential losses by evaluating claims against the probability of specific events occurring. This data-driven insight fosters an enhanced understanding of market potential, aiding in drawing up respective premium prices—an essential tool for risk management.

Investment Strategies Using Outcome Analysis

Institutions frequently deploy outcome analysis to refine investment strategies. Utilizing data analytics to assess investment trajectories helps organizations streamline their focus on more favorable outcomes. Explicitly comparing investment scenarios based on their expected returns enables savvy investors to pivot quickly and adjust their forecasts to bolster financial performance.

Key Takeaways

- Understanding expected value is crucial for quantitative decision-making and risk analysis.

- Employing the expected value formula provides insights into average outcomes and probabilities.

- Effective statistical models enhance economic analysis, allowing for refined portfolio management.

- Real-world applications, especially in gaming and investment strategies, underscore the value of expected return assessments.

- Data-driven insights can lead to prosperous decision optimization in various sectors.

FAQ

1. What is the expected value formula?

The expected value formula is outlined as EV = Σ (P(x) * x), where P(x) is the probability of each outcome x. By applying this formula, individuals can determine the average result of random experiments, assisting in decision-making and risk assessment.

2. How does expected value help in financial forecasting?

Calculating the expected value helps in estimating potential returns on investment. In financial forecasting, stakeholders can analyze various outcomes to make decisions that enhance performance measurements while considering associated risks.

3. Can you provide an example of expected value in economic analysis?

An effective example is government budgeting for infrastructure projects where policymakers evaluate the expected costs against anticipated societal benefits. This allows for informed choices that maximize economic gains, illustrating a practical application of value estimation.

4. What role does statistical expectation play in risk management?

Statistical expectation plays a vital role by quantifying probable losses and helping identify strategies for minimizing risk. Calculating expected values allows businesses to develop models that predict downturn scenarios, assisting in enabling proactive risk management strategies.

5. How do probabilistic models improve decision making?

Probabilistic models enhance decision-making processes by providing a structured way to assess uncertainties. By utilizing probability distributions, organizations gain confidence in their strategies, leading to more meaningful predictions and effective outcomes.