How to Properly Sign a Check Over to Someone Else: Essential Instructions for 2025

Signing a check over to someone else can be a straightforward process if you understand the rules and procedures involved. In 2025, it remains essential to know the correct way to endorse a check to ensure secure transactions. This article will guide you through the steps required, the terminology involved, and the tips for successfully transferring check ownership to another person.

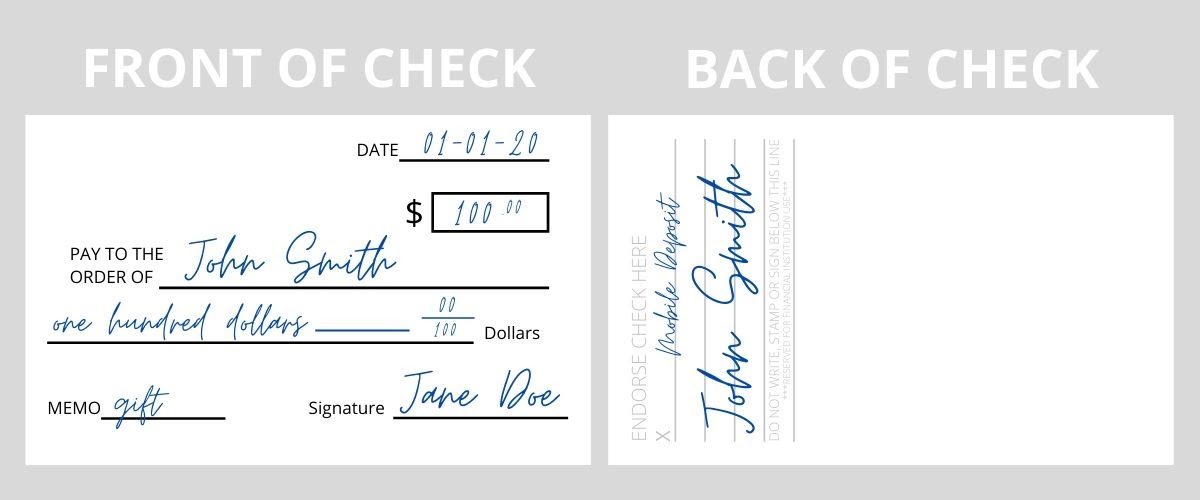

Understanding Check Endorsement

At its core, **check endorsement** involves signing the back of a check to authorize its payment to another party. When you’re figuring out how to sign a check over, it’s crucial to understand the different types of endorsements available. A check can be endorsed with a simple signature or transferred to a specific person, which enables the recipient to cash or deposit it. However, not all banks may accept endorsed checks, so it’s essential to check with your financial institution’s policies.

Types of Check Endorsements

The most common types of endorsements include:

1. **Blank Endorsement**: This is simply signing the check. It allows the check to be cashed by anyone who possesses it, making it less secure.

2. **Restrictive Endorsement**: Here, you can write “For deposit only” along with your signature. This restricts the check’s use only to depositing, enhancing its security.

3. **Special Endorsement**: This type involves writing “Pay to the order of [Recipient’s Name]” along with your signature. This instructs the bank to pay a specific person, making it clear who the check should be transferred to. This is likely the method you’d use when signing a check over to someone else.

Importance of Legal Endorsements

An understanding of **legal endorsement** protocols is vital in safeguarding against fraud. Banks have specific **check endorsement rules** to protect both the people involved in the transaction and their assets. Always consider the risks involved in transferring a check, and make sure both parties are clear on the terms. Always use clear language such as “Pay to the order of” to denote a third-party transfer. Keep in mind that improper endorsements can lead to delays or rejection during the check cashing process.

Step-by-Step Guide to Endorsing a Check

Endorsing a check properly involves several crucial steps. By meticulously following each phase of the **check signing process**, the transaction can be executed seamlessly. Below is a straightforward guide on how to sign a check for someone else.

Step 1: Verify Check Payability

<pBefore endorsing a check, ensure it's a legitimate and valid monetary document. Confirm the check is **payable to you**. If you find an anomaly, do not proceed with the endorsement. A legitimate **check payable to** you will ensure legally compliant transferring of funds.

Step 2: Endorse the Check on the Back

<pFlip the check over and clearly write:

“Pay to the order of [Recipient’s Name]”

then sign your name below this endorsement, adhering to the requirements for **endorsing checks legally**. This transfers ownership. Double-check the spelling of both the payee’s name and your own signature for clarity.

Step 3: Complete the Transaction

<pOnce the check is endorsed, you can hand it over to the new recipient. You may choose to write down any additional instructions, such as their obligation to deposit the check immediately, reinforcing your expectation for timely processing. Each bank has different policies regarding **check cashing** for third-party checks. The new check recipient should also verify with their bank for specific **check acceptance policies** to ensure a smooth transaction.

Common Mistakes to Avoid When Endorsing Checks

<pEven with a clear understanding of the endorsement processes, mistakes can still happen. Avoiding common pitfalls will significantly enhance the chances of a successful transfer when signing a check to another person.

Incorrect Endorsements

<pOne of the most frequent errors is not using clearlanguage in a **check endorsement**. Ensure to use recognizable language like "Pay to the order of" or "For deposit only" rather than vague terms. Some banks may reject checks due to incorrect language, delaying or complicating your financial transactions.

Failure to Verify Identity

<pBoth parties involved in a check transfer should always verify each other’s identities. Though you can rely on trust, this helps ensure the legitimacy of the transaction. If doubt arises, it’s better to err on the side of caution.

Forgetting to Sign Legibly

<pNever overlook the need for a clear endorsement signature. An illegible or faint signature can result in complications, leading to a **check payment policy** violation that could either delay custody rights to funds or facilitate losses in transactions. Ensure your name is clearly written and matches the name on the front of the check.

Financial Implications and Safety Measures

<pUnderstanding the financial implications of endorsing and transferring checks is essential. Engaging in this process without proper knowledge can result in costly mistakes or potential fraud.

Understanding Risks in Check Endorsement

<pRisks can include unauthorized cashing by third parties, which can result in lost funds. It's vital to utilize secure endorsement practices, ensuring you understand what you’re getting into before engaging in financial transactions. In our fast-paced banking system, maintaining a solid understanding of the **check transfer process** is paramount.

Secure Endorsing Processes

<pWhen involved in personal finance, promoting safety is vital. Always secure checks until they are endorsed and ready for transfer. Minimize risks by avoiding leaving checks unwatched, especially in public settings. Consider taking digital photos for records, and if misgivings arise, look into electronic check transfers as a secure alternative.

Key Takeaways

- Use clear language while endorsing checks to prevent confusion.

- Always verify the check’s payability and the identities of all parties involved.

- Ensure your signature is legible and matches the name on the check.

- Consider the security features of checks to prevent unauthorized transactions.

- Stay up-to-date with your bank’s policy on endorsed checks.

FAQ

1. Can I endorse a check to someone else if it is made out to me?

Yes, you can endorse a check that is made out to you to another person. You need to write “Pay to the order of [Recipient’s Name]” on the back and sign your name below this statement to complete the **check endorsement process**. However, always verify with your bank for their specific guidelines.

2. What are **check endorsement options** available based on my needs?

Commonly accepted options include blank endorsements, restrictive endorsements, and special endorsements. Choose one based on your needs. If you wish to transfer funds, use a special endorsement, explicitly stating “Pay to the order of” followed by the other person’s name for secure transactions.

3. If I sign a check for someone else, how can I ensure it is secure?

To ensure security, always use restrictive endorsements such as “For deposit only,” and clearly state the payee’s name. Keep the transaction discreet until the check is in the hands of its intended recipient, reducing the likelihood of fraud or misdirection.

4. What should I do if a bank refuses to cash an endorsed check?

If a bank denies cashing an endorsed check, inquire about their policies, focusing on valid **check endorsement practices**. Various banks have distinctive rules regarding endorsements. You may need to verify the identity of all parties involved again or provide additional identification.

5. Are there any legal implications if I incorrectly endorse a check?

Improperly endorsing a check can lead to legal complications, such as fraud claims or inability to recover funds if deposited incorrectly. It’s crucial to understand **legal aspects of checks** and comply with your bank’s regulations. Clear documentation can minimize such risks.

6. How does the bank handle check transfers between third parties?

Banks process check transfers through checking procedures that require proper endorsements. They may hold checks for a period to ensure funds are cleared, protecting against fraud. Understanding bank policies surrounding these transfers will guide your financial decisions wisely.

7. What steps can I take if I am signing checks for others frequently?

If you frequently find yourself signing checks for others, consider establishing a written agreement outlining the terms of each transaction. This practice ensures clarity and can protect you legally, enhancing responsible financial management.