How to Calculate Consumer Surplus in 2025

In the field of economics, understanding the concept of consumer surplus is fundamental for assessing consumer welfare and market efficiency. This article will provide you with effective methods for calculating consumer surplus in 2025, alongside essential formulas and examples that illustrate the principles of consumer surplus in different markets. Through in-depth analysis and practical applications, our goal is to equip you with comprehensive knowledge on this important topic.

Understanding Consumer Surplus

Before we dive into the methods for calculating consumer surplus, it’s crucial to grasp the meaning and significance of this concept. Consumer surplus represents the difference between what consumers are willing to pay for a good or service and what they actually pay. This measure reflects the economic benefit to consumers, illustrating their extra satisfaction gained from purchases. By understanding how to calculate consumer surplus, economists and businesses can better assess market dynamics and inform pricing strategies.

Definition of Consumer Surplus

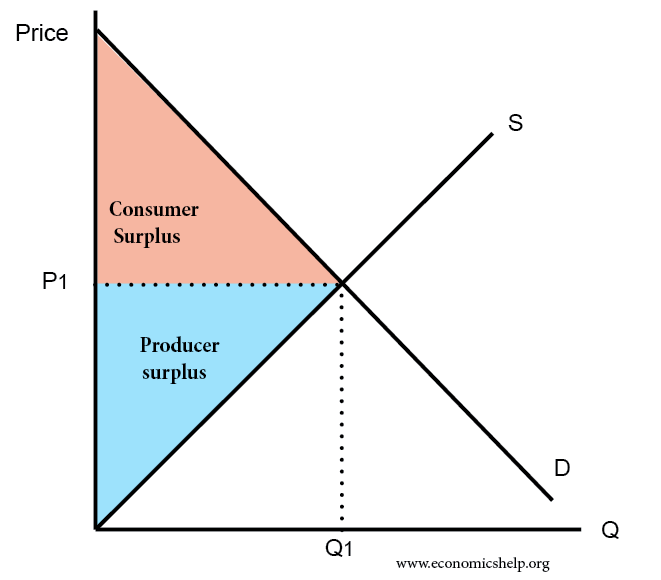

The definition of consumer surplus can be articulated as the area between the demand curve and the market price, demonstrating the extra value consumers receive from purchasing goods. For instance, if a consumer is willing to pay $100 for a product but only pays $70, the consumer surplus is $30. This surplus amount illustrates the benefit derived from the purchase and highlights the consumer’s welfare.

Importance of Consumer Surplus

The importance of consumer surplus lies in its ability to measure consumer welfare in an economy. It acts as an indicator of market efficiency and consumer satisfaction. For policymakers, understanding the changes in consumer surplus can inform decisions that enhance economic well-being. Moreover, businesses can utilize this information to develop pricing strategies aimed at maximizing consumer surplus, ultimately leading to higher sales and customer loyalty.

Graphical Representation of Consumer Surplus

A graphical representation simplifies the understanding of consumer surplus. On a graph, the price is displayed on the Y-axis and the quantity on the X-axis. The demand curve slopes downwards, reflecting that as prices decrease, quantity demanded increases. The area under the demand curve and above the market price up to a certain quantity represents consumer surplus. This visualization helps in analyzing how shifts in demand or price changes affect consumer welfare, leading to insightful discussions with peers and stakeholders regarding market conditions.

Calculating Consumer Surplus Step by Step

Now that we’ve established a solid foundational understanding, let’s delve into the practical aspects of calculating consumer surplus. There are advanced methods as well as step-by-step approaches that can lead to accurate calculations.

Consumer Surplus Formula

The consumer surplus formula is fairly straightforward. It is represented mathematically as:

Consumer Surplus = 1/2 * (Base * Height)

Here, the base represents the quantity of goods and the height signifies the difference between the highest price a consumer is willing to pay and the actual market price. Utilizing this formula allows for more efficient calculations, particularly in scenarios involving changes in supply and demand.

Calculating Consumer Surplus from Demand Curves

To accurately calculate consumer surplus from demand curves, one needs to first determine the demand equation. For instance, suppose the demand equation is given as P = 200 – 2Q (where P represents price and Q represents quantity). To find the consumer surplus at market equilibrium:

1. Calculate the equilibrium price.

2. Identify the quantity demanded at that price.

3. Draw the demand curve and find the area of the triangle formed above the price level and below the demand curve. With the base and height calculated, apply the ceramic formula for precision.

Examples of Consumer Surplus

Engaging in real-life examples of consumer surplus can illustrate this concept more clearly. For example, consider a new video game priced at $50. Many consumers are willing to pay up to $80. The consumer surplus for those consumers would be calculated as follows:

– Willingness to pay = $80

– Actual payment = $50

– Consumer surplus = $80 – $50 = $30.

This example demonstrates how understanding this surplus varies by individual preferences and the significance of pricing strategies across different consumer segments.

The Implications of Consumer Surplus

Understanding the nexus between consumer surplus and other market factors can lead to valuable insights into consumer behavior and policy making.

Consumer Surplus vs Producer Surplus

The relationship between consumer surplus vs producer surplus is an important aspect of market analysis. While consumer surplus reflects the benefits to consumers, producer surplus indicates the profits received by sellers above their supply costs. Together, these surpluses capture the overall economic surplus of a market, playing a key role in understanding market efficiency. Policymakers need to assess both types of surplus when proposing changes that impact pricing, taxes, or subsidies, as adjusting one can significantly affect the other.

Effects of Taxation on Consumer Surplus

Taxes can have profound effects on consumer surplus. They typically lead to a reduction in the consumer surplus by increasing product prices or reducing the quantity available. For example, if a government imposes a sales tax on a popular item, the effective price rises, leading to decreased buyer willingness to pay and, ultimately, a lower consumer surplus. Understanding these impacts helps consumers and policymakers critically evaluate fiscal policies and their repercussions on overall welfare.

Consumer Surplus in Welfare Economics

In the realm of welfare economics, consumer surplus serves as a pivotal measure of social welfare. An increase in consumer surplus often translates to enhanced welfare, indicating that consumers derive greater satisfaction from the goods available in the market. Analyzing **consumer surplus** in this context highlights its role in evaluating the success of economic programs and trade-offs faced by society while addressing issues such as rationing and resource allocation.

Measuring Consumer Surplus in Practice

The methods for measuring consumer surplus are not only confined to theoretical frameworks but also have practical applications, especially in diverse market environments.

Consumer Surplus in Different Markets

Across various market structures—from competitive markets to monopolies—the level of consumer surplus can vary significantly. In competitive markets, consumers often experience higher consumer surplus due to lower prices, whereas in monopolistic markets, producers may extract more surplus, leaving consumers with minimal benefits. Understanding the dynamics of how consumer surplus behaves in different market conditions is crucial for businesses as they refine their pricing strategies to optimize both sales and customer satisfaction.

Strategies to Increase Consumer Surplus

Various strategies to increase consumer surplus can be implemented, including enhancing product quality, optimizing pricing strategies, or distinct marketing aims that align well with consumer values. For instance, offering discounts or bundling products together can create scenarios where consumers feel they are deriving greater benefit, ultimately leading to heightened consumer loyalty and increased market participation.

Real World Applications of Consumer Surplus Calculations

To fully grasp consumer surplus calculations in real life, consider public transport pricing. Governments often utilize consumer surplus metrics to determine optimal pricing structures that maximize utility for commuters while ensuring sustainability within the system. By regularly monitoring service usage against pricing, authorities can strategically manage resources to enhance public service effectiveness, thus promoting higher levels of consumer satisfaction.

Key Takeaways

- Consumer surplus measures the economic benefit consumers gain when they can purchase goods at prices lower than their maximum willingness to pay.

- Understanding the implications of consumer surplus is essential for policymakers, businesses, and economists as it reflects market efficiency and welfare.

- Calculating consumer surplus can be accomplished using various methods, including geometric representations and practical examples that demonstrate its relevance.

- Policies affecting taxation and market structure can significantly impact consumer surplus levels, necessitating careful consideration during decision-making processes.

- Implementing strategies to enhance consumer surplus can lead to improved customer loyalty and robust market participation.

FAQ

1. What is the consumer surplus formula?

The consumer surplus formula is expressed as Consumer Surplus = 1/2 * (Base * Height), where the base indicates quantity and height signifies price difference. This simplicity enables easy calculation across various scenarios.

2. How do taxes affect consumer surplus?

Taxes typically decrease consumer surplus by raising effective prices, leading to diminished quantities demanded. Consequently, consumers experience reduced welfare, necessitating analysis of fiscal policies and their implications.

3. Can consumer surplus be measured in non-market settings?

Yes, measuring consumer surplus is possible in contexts such as public goods and non-compensated benefits from services. Applications in these contexts reveal consumer perceptions not captured in traditional markets.

4. What role does price elasticity play in consumer surplus?

Price elasticity greatly influences consumer surplus; if demand is elastic, a price decrease can significantly increase surplus, while inelastic demand limits the surplus change response to price alterations.

5. How does consumer surplus reflect economic welfare?

Consumer surplus acts as a vital metric in assessing economic welfare; higher consumer surplus signals increased satisfaction from market operations, reflecting overall economic balance and efficiency.